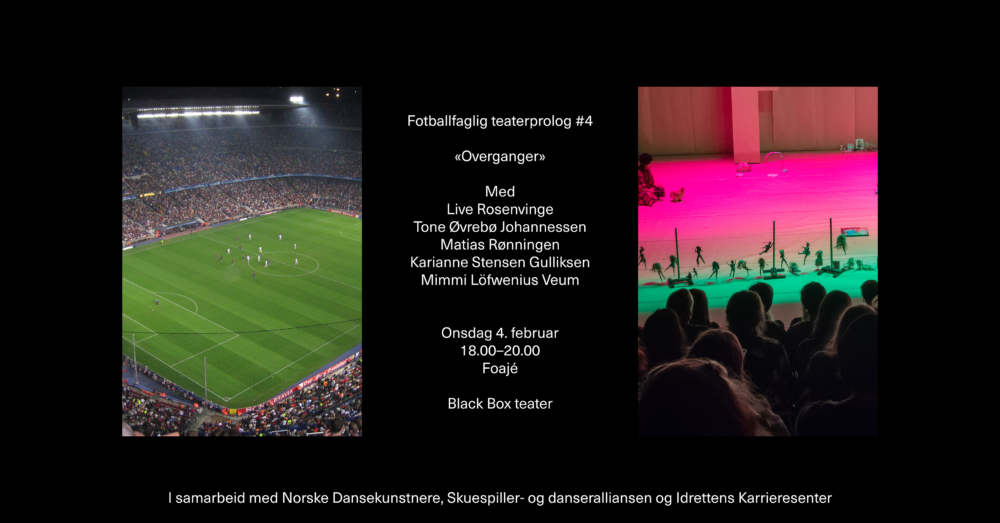

Fotballfaglig teaterprolog #4: Overganger

Hva skjer når en scenekunstner eller fotballspiller går fra å være fullt ut definert av sitt kunstneriske eller sportslige virke – til plutselig å måtte oversette og tilpasse denne erfaringen og kompetansen til arbeidsmarkedets språk? Anerkjenner storsamfunnet verdien av slike erfaringer?

Bli med på Fotballfaglig teaterprolog på Black Box der vi diskuterer karriereoverganger i scenekunsten og idretten.

Nasjonalt medlemsmøte i Norske Dansekunstnere 23.1.2026. Programmet er klart!

Savner du et faglig fellesskap i dansefeltet som bryr seg om det samme som deg? Nå søker vi etter dyktige og engasjerte ressurspersoner som ønsker å påvirke vårt arbeid og styrke vår faglige kompetanse på dansefeltet.

Under vårt Nasjonale Medlemsmøte i januar vil du få mer informasjon om fagfellesskapene. I tillegg kan du påvirke til hvilke grupper som opprettes og samtidig melde deg opp til de gruppene som er relevante og viktige for deg.

Høres dette interessant ut?

Med deg på og se all informasjon om møtet her!

Oppdaterte satser for koreografer på våre nettsider!

Nå har vi oppdatert satsene for koreografer i vår koreografavtale med Spekter.

Oppjusteringen trer i kraft fra 1. januar 2026. Reguleringen er i tråd med frontfagsnormen på 4,4%.

Mistillit til kunstnerne må ikke bli normen i den offentlige debatten

Debatten om Kulturrådet og Impure Company blander ulike saker. Når alt fremstilles som en skandale er det lett å bli redd for å uttrykke seg. Dermed mister vi også muligheten til å ta grep som kan bidra til å styrke kunstnerne og ordningene for kunsten. Som forbund er det vår oppgave å stå opp for dansen og holde hodet ryddig i møte med en debatt som fort går over styr. 17.12 hadde forbundsleder et debattinnlegg i Dagsavisen. Her kan du lese innlegget samt se noe av det vi mener og gjør rundt denne saken.

Vi bytter fakturasystem - dette betyr det for deg

Fra 01.01.26 bytter forbundet økonomisystemet Tripletex. I den forbindelse vil det innføres noen nye rutiner som dere bør kjenne til. Les alt om dette her!

NODA og PRODAs valgkomitè søker kandidater og innspill!

Valgkomiteen til NODA og PRODA har startet årets arbeid med å finne kandidater som ønsker å stille til valg i de ulike styrene og komiteene. Disse vil velges på NODAs generalforsamling og PRODAs årsmøte i 2026.

Frist for innspill er søndag 18. januar 2026.